The Wisconsin housing market saw substantial changes in 2022. As of December 2022, it was noted that Wisconsin’s median price for a home increased 7.8% from the previous year to $258,500. There were 4,580 homes sold in December 2022, compared to 6,948 homes sold in December of previous years, and a 34.1% decrease in sales on average. So, what does that mean for this year’s housing trends?

As we look ahead to 2023, there are several trends and predictions for the real estate market in Wisconsin that are worth considering.

Migration to Midwest

As affordability has been the main factor when it comes to buying homes in this economy, places that feature reasonably priced housing options are already seeing a shift their way. This is why the Midwest has remained a top-list contender.

Unlike every other region in the US, the Midwest hasn’t seen extreme housing prices like other areas. Lower rent and home prices will make it easier for residents and first-time buyers. Another factor for which the Midwest stands out is that most areas still have a relatively healthy market, as the declines in new listings are relatively smaller than the national average. This means that with the shift in relocating, there is more consistent demand from buyers, which has continued to aid the housing market so far.

Rent growth has outpaced salary growth, making it more difficult to cover or upgrade their rental choices. Over the previous five years, the average hourly pay has increased by 23%, but following a pandemic-era rise, rents have increased by 37% over the same period. In Milwaukee, though, rents fell by 0.8% over the course of November 2022, according to rental listing service Apartment List. This is a good trend for residents in 2023 that we could see continuing in Wisconsin.

Housing Investments May See Return Long-Term

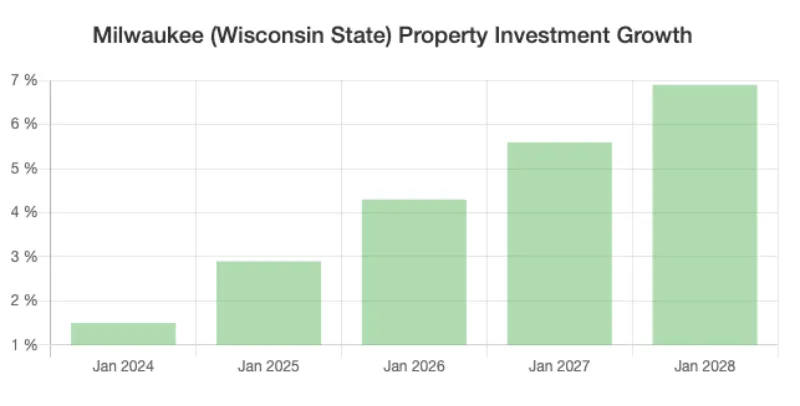

According to Walletinvestor’s Milwaukee real estate market research, home values will fluctuate. The trend shows values generally decreasing before increasing within the next few years.

Milwaukee’s real estate prices and its market environment have been in a slow growth period. It is predicted that there will be a general negative trend in the near (or short-term) future. This means that buying a house in Milwaukee for a short-term investment is not good for making a profit. But the investment return for Milwaukee homes is expected to be a great 5-year plus investment with an estimated 6.92% increase.

To put that into perspective, with this projected market increase for long-term investments, putting 100,000 USD in a Milwaukee property today could yield a growth up to 106,920 USD by 2028 (see graph above). Always read up on optimal real estate investment strategies if you are new to investing.

Multi-Generational/Multi-Family Homes On Rise

Another trend that is expected to continue is the rise in demand for multi-generational/family homes. With more adults living with their parents and grandparents, many families are looking for homes that can accommodate multiple generations. Furthermore, buying homes with friends or non-relatives has increased within this topic as well. This trend is expected to drive demand for homes with separate living spaces, such as in-law suites or basement apartments, as well as homes with multiple bedrooms and bathrooms.

A Zillow survey from spring 2022 found that “among successful recent homebuyers, 18% had purchased along with a friend or relative who wasn’t their spouse or partner, and 19% of prospective homebuyers intended to buy with a friend or relative in the next 12 months. For both groups, affordability and qualifying for a mortgage were cited as the top reasons for buying together.”

Renovations/Rental Properties May Increase

A trend that is expected to continue is the growth of the home renovation market. Although flipping houses in a generally bearish market is not recommended (especially for first-timers), it has become an increasing consideration to many homeowners who simply cannot afford to relocate or buy a new home.

As interest rates remain low, many homeowners are choosing to renovate their existing homes rather than buy new ones. This trend is expected to drive demand for home remodelers and contractors, as well as for materials and supplies used in home renovations.

Additionally, rental property construction will continue to see an increase. Price reductions are being driven by the temporary oversupply of new homes that are anticipated. These price reductions may also affect the existing home market, which would otherwise continue to experience low inventory levels as current homeowners hold onto their properties and their historically low mortgage rates.

Market Will Stabilize or Get Better

The housing market will still be driven by affordability in 2023, but there is a good probability that it will get better. The market may at least stabilize, enabling households to save money and make plans for future home purchases.

In the most hard-to-afford markets, Zillow predicts that national home values will actually decline next year. For the first time in two years, rents actually decreased in October 2022, indicating a return to normal seasonal trends. Because of constant demand, we have seen a shift to rental properties instead of single-home construction. Builders are constructing new homes at a record-breaking rate to enhance the availability of rental housing.

Takeaways

In conclusion, the real estate market in Wisconsin in 2023 is expected to be driven by a number of trends and predictions. It should be noted that many of these predictions and trends are compared using historical data from previous years when the economy and housing market reflected the same patterns.

These trends should not be taken as absolutes but as cautionary topics. For more information or questions regarding property management and investing in Milwaukee, contact Performance Asset Management today.